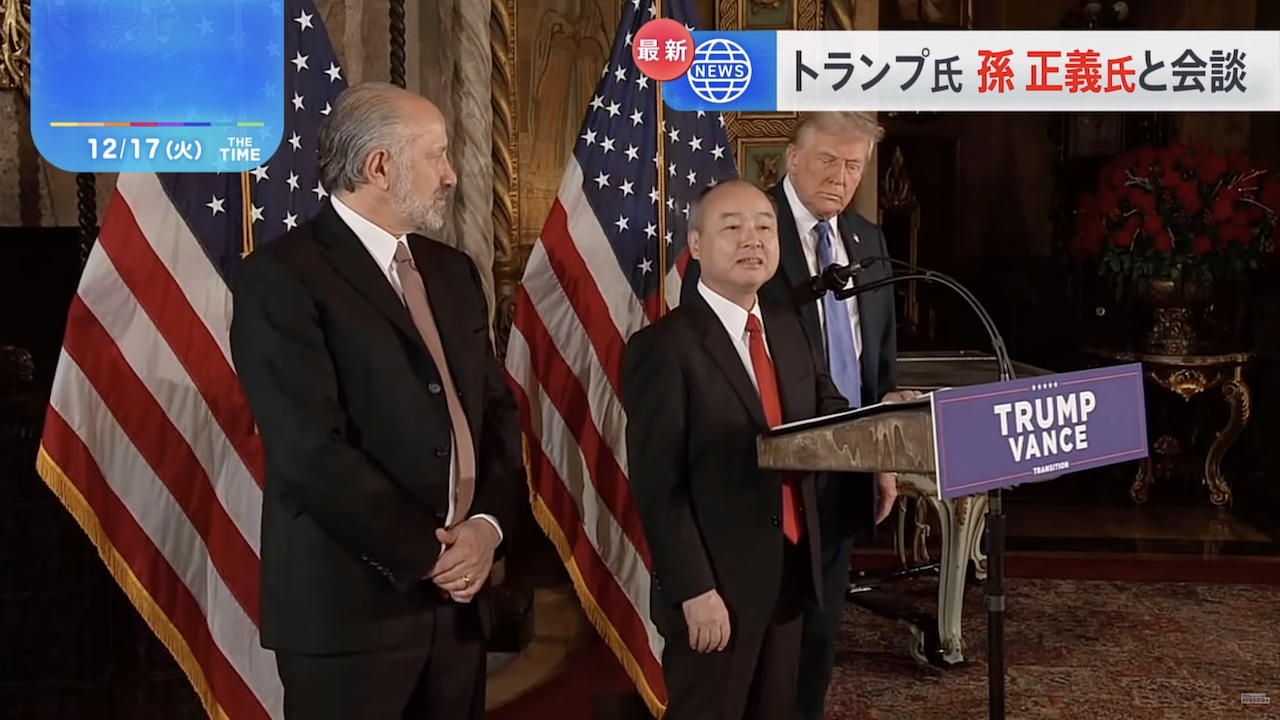

MIAMI, Dec 17 (News On Japan) - SoftBank Group Chairman and CEO Masayoshi Son has announced a $100 billion investment in the United States, equivalent to approximately 15 trillion yen, following a meeting with U.S. President-elect Donald Trump at Trump’s Florida residence on December 16. The investment is expected to create 100,000 jobs over the next four years.

At a joint press conference, Trump described the pledge as a "historic investment" that reflects significant confidence in America’s future. He praised Son, saying, "Masa [Son] has a deeper understanding of emerging technologies than anyone else. It’s an honor."

Although details were sparse, the investment is believed to focus on AI-related projects, including data centers for artificial intelligence development. This marks a doubling of Son’s previous pledge made in December 2016, when he promised $50 billion in investments and 50,000 jobs after Trump’s election victory.

Son explained the increase, stating, "Confidence in the U.S. economy has doubled, so the investment amount has doubled as well." During the press conference, Trump urged Son to expand the investment further to $200 billion, to which Son replied, "I want to make it happen. President Trump is an exceptional negotiator."

This significant announcement underscores Son’s confidence in U.S. economic prospects and highlights SoftBank’s continued commitment to advancing cutting-edge technologies.

Source: TBS