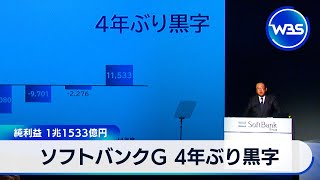

TOKYO, May 14 (News On Japan) - SoftBank Group has returned to profitability for the first time in four years, reporting on May 13th a net profit of 1.1533 trillion yen for the fiscal year ending March 2025, driven by a global rebound in stock markets that sharply boosted the value of its investment holdings.

This marks a significant turnaround from the previous year’s loss, driven by a strong recovery in global equity markets. The value of shares in its portfolio companies rose sharply, resulting in investment gains of approximately 3.7 trillion yen.

In recent years, SoftBank Group has undergone a dramatic transformation marked by both aggressive investment strategies and significant financial volatility. Founded and led by Masayoshi Son, SoftBank pivoted from its origins as a telecommunications company to become a major technology investor, most notably through its Vision Fund. The Vision Fund, launched in 2017 with backing from Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala, raised nearly $100 billion and rapidly became one of the world’s largest tech-focused investment vehicles. Through this fund and subsequent iterations, SoftBank poured capital into a wide range of companies, including Uber, WeWork, Didi, ARM, and Coupang. The strategy relied heavily on bold bets in unprofitable but high-growth startups, with the expectation that scale and disruption would eventually deliver returns.

However, this approach exposed SoftBank to high levels of risk, and the group experienced major financial turbulence, particularly during the COVID-19 pandemic and the tech stock downturn that followed in 2022. One of the most high-profile setbacks was the implosion of WeWork, which SoftBank had heavily funded and attempted to rescue after its failed IPO. Losses also mounted from investments in Chinese companies like Didi and Alibaba amid Beijing’s regulatory crackdown on the tech sector. As a result, SoftBank posted record losses—over 3 trillion yen in some quarters—driven by plunging valuations in its investment portfolio. These struggles prompted Son to step back from public appearances and reduce SoftBank’s exposure to volatile markets, selling down assets such as shares in Alibaba and T-Mobile to shore up its balance sheet.

At the same time, SoftBank began to reposition itself around AI and semiconductor infrastructure. It pursued a highly anticipated IPO of its British chip designer ARM, which finally materialized in September 2023 on the NASDAQ, offering a potential long-term revenue source amid the AI boom. ARM’s listing helped replenish SoftBank’s liquidity and restored some investor confidence. Meanwhile, the company emphasized a strategic focus on artificial intelligence as the future of its investment thesis, with Son declaring that AI would be the "core of SoftBank’s evolution." The fiscal year ending March 2025 marked a return to profitability for the first time in four years, reflecting a rebound in global equity markets and a significant turnaround in the valuation of its portfolio companies. Although risks remain high, SoftBank appears to be entering a new phase of recovery, with renewed emphasis on discipline, asset reallocation, and AI-centered innovation.

Source: テレ東BIZ