TOKYO, Feb 22 (News On Japan) - "Debt Completely Forgiven!? – such advertisements, implying that anyone can reduce their debt, are familiar to many.

The term "debt restructuring" refers to a system designed to help rebuild the lives of those with multiple debts. However, there have been increasing reports of individuals who, despite seeking help from lawyers or judicial scriveners, have ended up with even more challenging financial situations.

A woman in her 40s, who sought legal help after seeing an online ad promising debt reduction, had borrowed 650,000 yen from consumer finance companies for living expenses and was struggling with repayments. In March 2023, while watching a video streaming service on her smartphone, she came across a video ad featuring testimonials like "I reduced my debt!" and clicked on it out of curiosity. She was directed to a website offering a free debt reduction diagnosis and entered her debt amount and contact information, which led to a call from a law firm in Tokyo.

After communicating with the law firm's staff via LINE and email, she was instructed to transfer a monthly deposit. Since the amount was about 1,000 yen less than her previous monthly repayments, she decided to proceed and paid approximately 130,000 yen over eight months. However, in December, she was told that the settlement with the consumer finance company amounted to 760,000 yen, including delayed interest – her debt had not decreased. Doubting this, she consulted with a consumer affairs center run by her local government and was informed that she should have pursued bankruptcy proceedings. She canceled her contract with the law firm through a judicial scrivener from a support organization, but the money she had paid, believing it to be a deposit, was not returned as it was considered a retainer fee.

40-year-old woman: "I believed the video ad with happy testimonials about debt reduction, and I only received a very simple explanation about the payments. I thought it must be legitimate since it was coming from a lawyer. I had a strong desire to reduce my debt as quickly as possible..."

"Beware of Fraudulent Online Ads"

Shinichi Niikawa, a judicial scrivener and deputy secretary-general of the "National Association of Consumer Credit and Life Debt Victim Liaison Council," a support group for multiple debtors, says that if the woman's financial situation had been properly assessed, debt negotiation would have been inappropriate.

Judicial Scrivener Shinichi Niikawa: "Despite knowing that long-term debt negotiation would not reduce the individual's debt, the law firm seems to have created a business model that deliberately leads to settlements and fees. Among the online ads used to attract a large number of clients, there are some that border on fraud, and the industry must take collective action."

"Countermeasures Against Online Ads" Leads to New Organization

In response to such concerns, a new organization is being formed to advance countermeasures. The "National Conference on Secondary Damage Prevention for Debt Restructuring by Mass Advertising Firms" is scheduled to be established in March, comprising lawyers, judicial scriveners, and supporters of multiple debtors.

At a preparatory meeting held online on February 17, about 20 participants, including lawyers, judicial scriveners, and supporters of multiple debtors, gathered. A man in his 30s, who had requested debt restructuring from two law firms based on internet ads, shared his painful experience.

Man in his 30s: "The fees for hiring a law firm for one case were so high that my payment amount increased, leading to the absurd situation of borrowing money from illegal lenders to cover the costs, which only made my life harder."

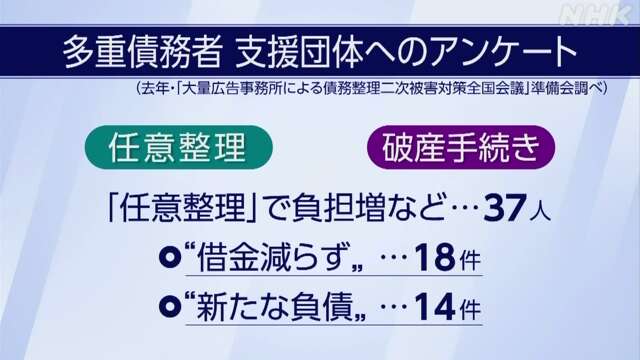

What Exactly is "Debt Restructuring"? Debt restructuring methods include "debt negotiation," where you negotiate with creditors to pay an affordable amount each month, and "bankruptcy proceedings," conducted in court to have debts forgiven. Lawyers and judicial scriveners tasked with these cases are expected to provide support tailored to the debtor's living situation. However, a 2022 survey of multiple debtor support organizations nationwide revealed that 37 individuals had sought legal assistance through online ads and, despite needing to file for bankruptcy, were guided towards debt negotiation, which only increased their burden.

Among the consultations, there were 18 cases where the debtor's debt did not decrease and 14 cases where they incurred new debts due to payments to the law firm. Additionally, 30 out of the 37 individuals proceeded with their cases online without ever meeting a lawyer or judicial scrivener in person. The support organization launching next month plans to offer free phone consultations to assist multiple debtors and aims to grasp the extent of the damage.

Lawyer Mikami Rii at the preparatory meeting: "We want to consult with people who sought help from lawyers through online ads without proper interviews or explanations and ended up without a resolution or in a worsened situation. With misleading terms like 'government-approved debt relief program' flooding the internet, we also want to address the nature of online advertising."

Disciplinary Actions Over Exaggerated Advertising

Cases have arisen where lawyers' exaggerated advertising has been deemed worthy of disciplinary action. The Chiba Bar Association is reviewing a case involving a lawyer in his 70s who advertised victim relief for investment and romance scams with claims like "Leave everything to us, and we'll solve it completely" and used logos of the Consumer Affairs Agency and the Financial Services Agency in online ads. In June 2023, the lawyer was judged to have potentially violated the Japan Federation of Bar Associations' regulations against "exaggerated advertising or advertising that creates excessive expectations," and the content of the disciplinary action is under review. The Japan Advertising Review Organization (JARO) also reports that it has received approximately 200 complaints each year for the past three years about advertisements for consultation services from law firms, including those with misleading expressions suggesting the possibility of money being returned.

Where to Consult?

For those struggling with debt, there are various consultation services available, such as free legal advice from the Legal Support Center (Houterasu) and free consultation sessions organized by local bar associations. However, it has been noted that fewer people are attending these consultation sessions recently. Lawyers interviewed for this report expressed concern that the number of people who seek debt restructuring through online ads and end up in greater hardship may be increasing. Consultation services for multiple debts are available through bar associations and judicial scrivener associations in each prefecture, consumer affairs centers run by local governments, and the Japan Federation of Bar Associations' Sunflower Hotline.

Japan Federation of Bar Associations Sunflower Hotline: 0570-001-240 (Weekdays 10:00 AM to 12:00 PM, 1:00 PM to 4:00 PM)

The support organization advises individuals to first consult these available services.

Source: NHK