TOKYO, Jul 22 (News On Japan) - The demand for advanced semiconductors, driven by AI technology, is rapidly increasing, creating high expectations for Japanese semiconductor material manufacturers. We spoke with Takahashi, CEO of Resonac, a leading manufacturer in semiconductor materials, about Japan's competitive advantages.

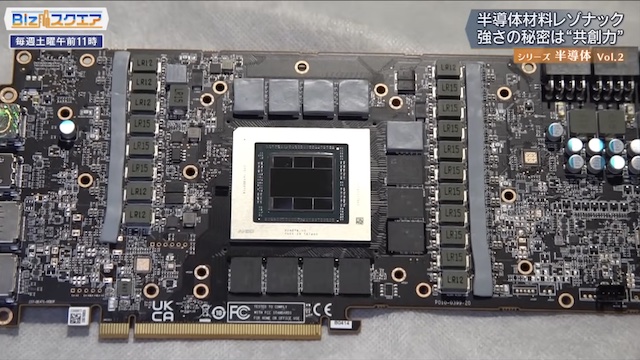

Resonac, formed from the merger of the former Showa Denko and Hitachi Chemical, is a top-tier semiconductor materials manufacturer. Semiconductor production involves front-end processes for circuit formation and back-end processes for packaging, with Resonac excelling in the latter. The company holds a leading global share in six types of materials used in back-end processes.

Semiconductor materials must protect circuits from thermal shock, ensure insulation, adhesion, and heat resistance. The rise of AI-generated content has boosted the demand for advanced semiconductors. A key focus in enhancing performance is advanced packaging, which involves stacking multiple chips with different functions into a single package. Resonac's materials, particularly their adhesive sheets, are in high demand. These sheets ensure secure attachment of memory chips, connect electrodes, and maintain uniform thinness, enhancing computing power and reducing energy consumption.

To explore Resonac's strengths, we visited their development hub in Kawasaki. The Packaging Solution Center, an open development facility, houses all back-end manufacturing equipment, significantly accelerating development speeds. Additionally, Resonac has established the Joint 2 consortium with 14 other companies to address next-generation semiconductor manufacturing challenges.

Japan remains strong in materials, equipment, and substrates. The challenge lies in maintaining and expanding this strength through collaboration rather than competition. Resonac's formation stemmed from Showa Denko's acquisition of Hitachi Chemical for 960 billion yen, orchestrated by Takahashi, then the head of strategic planning.

Takahashi views Resonac's formation as creating a new company, considering himself a founder. Resonac aims to evolve from a petrochemical-centered company to a global leader in functional materials. A key focus for Takahashi is fostering competitive talent. Imai, the head of HR, emphasizes that the core of the company's value lies in innovative, front-line personnel collaborating across divisions.

At a recent "Moyamoya" meeting in Kawasaki, employees voiced concerns and brainstormed solutions using Resonac's core values. Takahashi and Imai have held 50 such meetings, fostering a culture of open dialogue. Ensuring psychological safety is vital for fostering innovation.

In an interview, Takahashi discussed Japan's semiconductor strength. While Japan's semiconductor companies have declined, equipment and materials companies remain strong, holding the top global shares in many back-end materials. Resonac excels in combining resin-based organic materials with inorganic fillers, a process that requires extensive collaboration with customers to optimize formulations.

The Joint 2 consortium enables simultaneous collaboration with equipment and material manufacturers, enhancing development efficiency. This consortium is crucial for developing next-generation packaging solutions, which involve stacking memory and logic chips on a single substrate.

Resonac is also establishing a similar platform in Silicon Valley, anticipating that tech giants like Google, Apple, and Amazon will design their own AI semiconductors. This US Joint initiative aims to align with these companies from the concept stage, ensuring Resonac's materials meet future needs.

Takahashi sees continuous innovation and collaboration as keys to maintaining Resonac's competitive edge in the rapidly growing semiconductor market.

Source: TBS