TOKYO, Jul 02 (News On Japan) - Land prices, a benchmark for property valuation used in inheritance tax declarations, have seen significant changes this year. Shibuya, currently undergoing extensive redevelopment, has ranked second nationally for the first time.

Reporter: "Next Monday, a new building will open next to Shibuya Hikarie."

Set to open on July 8 along Aoyama Street in Tokyo’s Shibuya, the new complex building "Shibuya Axes" is part of what is being called a "once-in-a-century" large-scale redevelopment in Shibuya.

In front of Shibuya Station's Hachiko exit, high-rise buildings like "Shibuya Scramble Square," which opened in 2019, have increased compared to eight years ago. This surge in development is reflected in the land price evaluations.

The National Tax Agency announced today that the land price in front of "QFRONT" in Shibuya is now second only to "Kyukyodo" in Ginza, a first since records began.

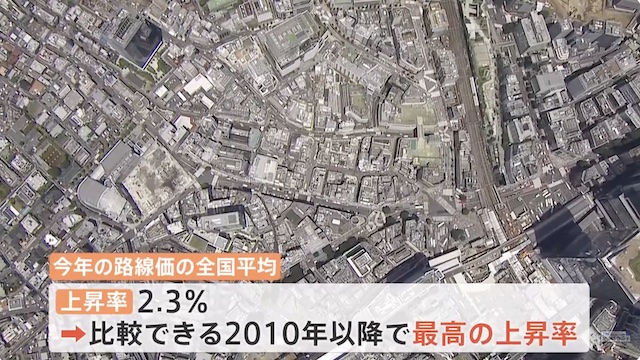

The nationwide average increase in land prices this year is 2.3%, the highest since 2010. Experts attribute this to the recovery in consumption driven by inbound tourism and a weaker yen.

Kenichiro Yume, Chief Researcher at the Urban Future Research Institute, explains: "The number of foreign visitors has surpassed 2019 levels, and the weaker yen has significantly boosted per capita travel spending. As consumption recovers, demand for retail and hotel space increases, creating a cycle where higher tenant demand leads to rising real estate prices and land values."

Asakusa, a popular tourist destination, recorded the highest rate of land price increase in Tokyo. Near Kaminarimon, foreign tourists are a common sight.

A rickshaw driver notes: "The number of overseas customers has significantly increased compared to last year. When I asked one customer why they came, they said 'yen depreciation,' and I thought 'wow.'"

After the COVID-19 pandemic, land prices are rising again. Experts predict continued upward trends.

Kenichiro Yume adds: "Compared to a year ago, the current exchange rate of 160 yen to the dollar represents about a 20% depreciation. This favorable condition, compared to 2019, will likely persist."

The trend of rising land prices is expected to continue.

Source: TBS